alybaba.site

Learn

Is 3.25 A Good Mortgage Rate For 30 Years

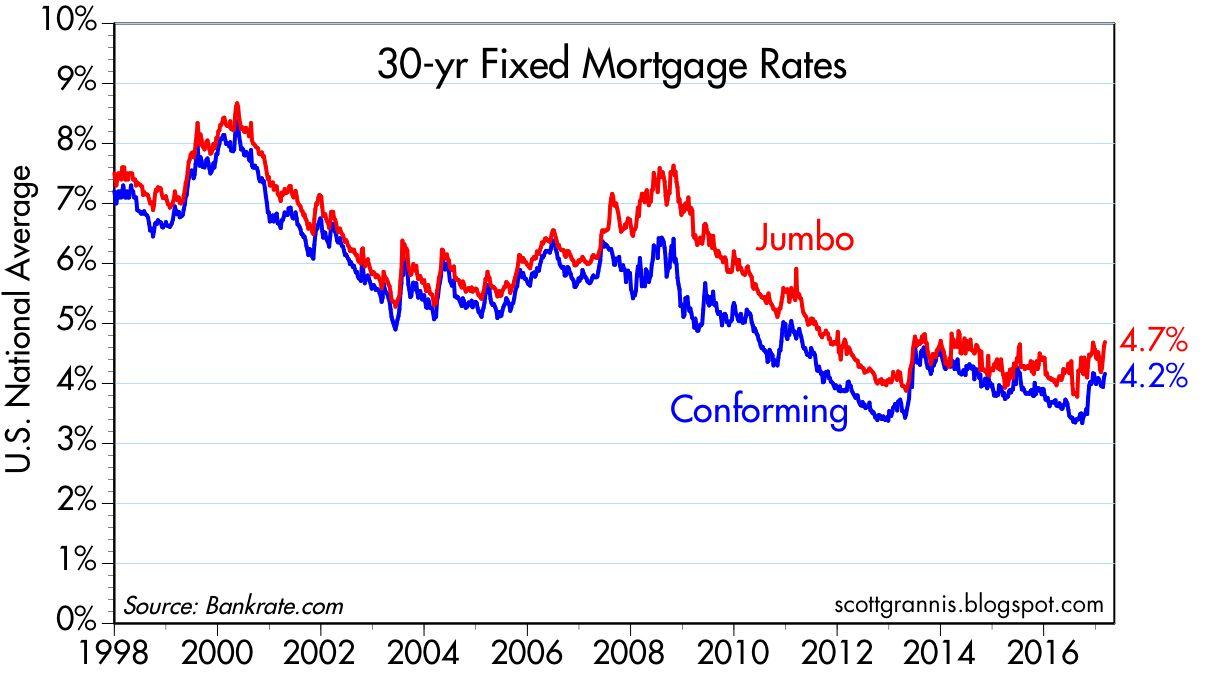

A year fixed-rate mortgage is the most common term, or length in number of years, of a home loan. It provides the security of a consistent principal and. The average forecast sees the 5-year fixed mortgage rate dropping another half a percentage point by the end of The most optimistic estimate is a drop of. While a year mortgage can make your monthly payments more affordable, a year mortgage generally costs less in the long run. calculatedrisk notes a Goldman Sachs forecast that the FFR will stabilize around % and argues this implies year mortgage rates will remain in the. A % interest rate is near the all time low. So yes, you have a good rate, assuming you are talking about a 30 year fixed rate loan. Continue. Mortgage rates continue to hover near the lowest levels of the year. The year fixed rate currently sits at %, % APR with points. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. This chart covers interest rates from 1% to %, and loan terms of 15 and 30 years. Each of the term columns shows the monthly payment (Principal + Interest). The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. For more information regarding Freddie Mac's. A year fixed-rate mortgage is the most common term, or length in number of years, of a home loan. It provides the security of a consistent principal and. The average forecast sees the 5-year fixed mortgage rate dropping another half a percentage point by the end of The most optimistic estimate is a drop of. While a year mortgage can make your monthly payments more affordable, a year mortgage generally costs less in the long run. calculatedrisk notes a Goldman Sachs forecast that the FFR will stabilize around % and argues this implies year mortgage rates will remain in the. A % interest rate is near the all time low. So yes, you have a good rate, assuming you are talking about a 30 year fixed rate loan. Continue. Mortgage rates continue to hover near the lowest levels of the year. The year fixed rate currently sits at %, % APR with points. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. This chart covers interest rates from 1% to %, and loan terms of 15 and 30 years. Each of the term columns shows the monthly payment (Principal + Interest). The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. For more information regarding Freddie Mac's.

Please note that interest rates are better on DSCR ratios of 1 or above and year amortized home loans require repayment over the course of months. With a shorter loan term and lower interest rate, a or year fixed-rate mortgage can help you pay off your home faster and build equity more quickly. When you get a mortgage, you DO have some control over your interest rate. One way to get a better rate is through a rate buydown. Contact us to learn more! My lender says we got a great rate at %. Then I spoke with a friend who says his lender is getting him between %. Also, mortgage rates change all the time. A good rate one day could look very different from the next. Currently, while % isn't the best rate possible, it. While a year mortgage can make your monthly payments more affordable, a year mortgage generally costs less in the long run. A good home loan calculator such as the one offered by Rate will If you take out a year fixed rate mortgage, this means: n = 30 years x Rate based on current prime rate minus a margin of % with a floor rate of %. Payment plans are 10 years interest only with a minimum monthly. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Smaller monthly payments: Paying off a loan over 30 years means you're responsible for a lower payment. The monthly savings can help you pay off high-interest. Other loan limitations may apply. While year-end rebates and rewards occur with great regularity, this credit union benefit is not guaranteed. Loan interest. Adjustments for the 3, 5, 7, and 10 year Adjustable Rate Mortgages (ARMs) is based on the 30 Day Average of the Secured Overnight Financing Rate as. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent of. Certain mortgage rates, like variable rate mortgages, home equity loans and The U.S. Prime Rate is not always the lowest, the best or the favored rate of. Great rates. Personal service. Fast turnaround. ; Fixed Rate Mortgages All other Purchase and Refinance Loans ; 30 Year Fixed. 2. 1. 0. %. %. %. If you chose a 3/1 ARM with % rate, you'd pay roughly $1, per month in mortgage interest and principal. A year fixed-rate mortgage at %, which. A good home loan calculator such as the one offered by Rate will If you take out a year fixed rate mortgage, this means: n = 30 years x For best rate, you must have checking, auto pay, direct deposit, and first mortgage with Community First Credit Union. Monthly payment is based on payment per. Meanwhile, the current average rate for a year fixed-rate mortgage is %. What happens when the Fed increases or decreases interest rates. The FOMC. To decide what the best loan term is – Mortgages are commonly offered with either 15 or year terms. Longer-term lengths will reduce your monthly payment.

Certificate Programs At Harvard University

Earn a professional certificate from top universities and institutions including Harvard, MIT, Microsoft and more. Online certifications available in Harvard Professional & Executive Development Certificates of Leadership Excellence (CLE) are specifically designed for leaders with the desire to advance their. Online Business Certificate Courses. Gain applicable skills, build new business capabilities, and tap into the confidence you need to improve your organization. The Global Health Delivery Intensive (GHDI) is a Harvard TH Chan School of Public Health (HSPH) non-degree program offered virtually every July. Welcome to The Academies! We offer pre-professional programs for high school students, taught at Harvard. Learn more about our on-campus and virtual. Offering a diverse array of tailored programs in Leadership, Management, Finance, Marketing, and Cybersecurity, Harvard's courses are more than an education –. Online courses from Harvard University · Courses · Programs · Executive Education · Degree Programs · BROWSE COURSES · START A NEW CAREER · STEP-BY-STEP GUIDES. Undergraduate Programs · Bachelor of Liberal Arts Degree Program · Joint Undergraduate and Graduate Program · Undergraduate Coding Certificate · Undergraduate. Harvard online courses follow the same quality of education even at the online platforms. You can pick courses from data science, computer science, business. Earn a professional certificate from top universities and institutions including Harvard, MIT, Microsoft and more. Online certifications available in Harvard Professional & Executive Development Certificates of Leadership Excellence (CLE) are specifically designed for leaders with the desire to advance their. Online Business Certificate Courses. Gain applicable skills, build new business capabilities, and tap into the confidence you need to improve your organization. The Global Health Delivery Intensive (GHDI) is a Harvard TH Chan School of Public Health (HSPH) non-degree program offered virtually every July. Welcome to The Academies! We offer pre-professional programs for high school students, taught at Harvard. Learn more about our on-campus and virtual. Offering a diverse array of tailored programs in Leadership, Management, Finance, Marketing, and Cybersecurity, Harvard's courses are more than an education –. Online courses from Harvard University · Courses · Programs · Executive Education · Degree Programs · BROWSE COURSES · START A NEW CAREER · STEP-BY-STEP GUIDES. Undergraduate Programs · Bachelor of Liberal Arts Degree Program · Joint Undergraduate and Graduate Program · Undergraduate Coding Certificate · Undergraduate. Harvard online courses follow the same quality of education even at the online platforms. You can pick courses from data science, computer science, business.

Certificate Programs · Leading Digital Transformation in Health Care · Clinical Development Strategies: Beyond Clinical Trials · AI in Health Care: From Strategies. The Harvard Medical Physics Residency Program includes a CAMPEP-accredited Certificate Program, which enables individuals with a non-CAMPEP medical physics Ph. Jump start your career with a professional certificate or take all the preparation you need for entering the MBA program. (Undergraduate transfer credits for. Enterprise leadership development that leverages world-class Harvard Business Publishing content and delivers real business impact. Each program offers varying levels of certification—from undergraduate credit to a Credential of Readiness. Explore what you can earn and the requirements. at Harvard University while engaging in coursework at Berklee College Students may elect to participate in courses and programs offered by the Harvard. Enterprise leadership development that leverages world-class Harvard Business Publishing content and delivers real business impact. Find best Harvard University courses online via Shiksha Online. Choose top rated online Harvard University courses on Shiksha Online & build. Harvard Medical School and Boston University School of Medicine. Dr Scientific and training programs with Harvard Medical School, Cambridge. The tuition fee for the in-person Phase II hosted by PIFS and Harvard Law School is USD 7, Focus on regulatory policy designed to remain ahead of the curve. Upon successful completion, all participants will be awarded a Harvard Business School Certificate of Program Completion. The Cohort is now closed to. Each certificate includes 15 self-directed online courses, offering participants both flexibility and affordability. Unfortunately, no. You do not hold a degree from Harvard. I am not sure what Harvard's process is for allowing departments and schools to offer. Professional Certificate Programs ; header image for Harvard University logo for Harvard University ; header image for The Wharton School of the University of. Choose from Nine Certificate Specializations ; alybaba.sitementCertificate in Leadership and Management. Budgets and Financial Reports ; alybaba.siteing. Harvard Medical School's postgraduate certificate programs are designed to help you acquire the latest skills and knowledge in the field. Find every English-taught Short Course from Harvard University, organised by subjects and best info to help you select the right degree. Leading People and Investing to Build Sustainable Communities is a certificate program created through the collaboration of AFOA Canada, the Harvard. When partnering with Harvard University, we created an innovative, multidisciplinary certificate program and short courses designed to help students thrive. Under the supervision of the Harvard Faculty of Arts and Sciences, HES offers over courses spanning various liberal arts and professional disciplines.

Parlay Meaning Betting

A 'parlay' bet is a bet placed on multiple outcomes (or legs) to occur. For a parlay bet to win, all outcomes (or legs) within the parlay must be selected. The most common is the same game parlay, allowing you to parlay different bets from the same event into one bet. You can also wager on round-robin parlays that. A parlay is one wager on two or more bets that are tied together for a larger payout. For the parlay to win, all bets involved must win. A parlay combines two or more bets that must all be won for the bet to pay off. It's a risky, but lucrative wager that has taken over social media. Definition of Correlated Parlays. I'm going to keep it simple. A correlated parlay is a wager in which you have two bets that are tied together. If one. A parlay is a single bet that links two or more wagers; to win the bet, the player must win all the wagers in the parlay. If the player loses one wager, he. Definition of a Parlay Bet: A parlay bet is a combination of multiple bets into a single wager. All of the bets on the parlay ticket must win for the parlay. What is a Parlay Bet & How Does It Work? For sports bettors, parlays are combination bets that involve folding several discrete wagers into a single. A parlay bet simply combines multiple wagers into one bet. It does this by rolling over the winnings from each individual wager into the next leg of the wager. A 'parlay' bet is a bet placed on multiple outcomes (or legs) to occur. For a parlay bet to win, all outcomes (or legs) within the parlay must be selected. The most common is the same game parlay, allowing you to parlay different bets from the same event into one bet. You can also wager on round-robin parlays that. A parlay is one wager on two or more bets that are tied together for a larger payout. For the parlay to win, all bets involved must win. A parlay combines two or more bets that must all be won for the bet to pay off. It's a risky, but lucrative wager that has taken over social media. Definition of Correlated Parlays. I'm going to keep it simple. A correlated parlay is a wager in which you have two bets that are tied together. If one. A parlay is a single bet that links two or more wagers; to win the bet, the player must win all the wagers in the parlay. If the player loses one wager, he. Definition of a Parlay Bet: A parlay bet is a combination of multiple bets into a single wager. All of the bets on the parlay ticket must win for the parlay. What is a Parlay Bet & How Does It Work? For sports bettors, parlays are combination bets that involve folding several discrete wagers into a single. A parlay bet simply combines multiple wagers into one bet. It does this by rolling over the winnings from each individual wager into the next leg of the wager.

If you parlay a bet, then you take the winnings from one bet and bet it again on something else. You might have seen a gambler on TV parlay her winnings into a. 3 meanings: 1. to stake (winnings from one bet) on a subsequent wager Brit equivalent: double up 2. to exploit (one's talent). Bettors can use these parlays to string together multiple markets/props from the same game, often in pursuit of large payouts. By correlated wagers, we mean two. A parlay is made up of two or more bets in the same wager. All your picks must win to receive a payout – if one loses then the whole bet is void. A parlay bet is a common form of wagering where two or more bets are combined together into a single bet. A parlay bet (also known as accumulator or combo bet) is a type of bet consisting of at least 2 bets. Simply, it is one bet that links two. The caveat is that you must get all of the wagers correct to win the bet. On this page we'll explain everything you need to know to start betting parlays and. Parlay betting allows sports bettors to combine their predictions into a single bet. For example, multiple NFL odds can get combined into one bet, and all must. A parlay is a multi-wager bet that requires all of the legs to win in order for you to cash your ticket. The more teams you include, the more money you can. A progressive parlay involves multiple bets (usually up to 12) and rewards successful bettors with a large payout, though not as large as normal parlays. From. With a parlay bet, the betting company multiplies the implied probabilities together. So two 2/1 bets would combine into one 8/1 bet. So if you. Instead of risking money on a single outcome, parlay bets require you to wager that multiple outcomes will occur. If all of your selections in a given parlay. A parlay is an all-or-nothing style of wager where more than one outcome must occur for the bet to win. No matter how large the parlay is, it loses if you get. A parlay bet (also known as accumulator or combo bet) is a type of bet consisting of at least 2 bets. Simply, it is one bet that links two. A parlay is a bet that combines two or more single wagers into one bet, increasing the payout with each additional bet - the more bets added to the parlay, the. A parley bet combines at least two individual wagers into one bet. These can be wager on two different games or selections from the same game. A parlay bet is a bet involving two or more separate selections, all of which must come in for the bet to win. Parlay betting is a form of football wagering where you pick two or more games on the same ticket and get a better payout (profit potential). Two touchdowns is less, three touchdowns is more — meaning this bet either wins or loses. You can also parlay bets across sports (a Packers and NWSL's. A parlay bet can, in theory, contain as many wagers as you like, though it's usual for fans to include two to six separate bets. How To Understand Parlay Odds.

How Much Is Inherent Tax

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

TAX RATES. The rates for Pennsylvania inheritance tax as of July 1, are as follows: • 0 percent on transfers to a surviving spouse or to a parent from a. Revised the estate tax to conform to the repeal of the inheritance tax by imposing an estate tax on the estates of resident and nonresident persons who have. Filing threshold for year of death ; , $11,, ; , $11,, ; , $11,, ; , $11,, INTRODUCTION. Transfer Inheritance Tax is a “beneficiary” tax, and is based on who specifically receives a decedent's assets, and how much each beneficiary. Estate tax is a tax on the gross value of an estate transferred at death to the person's designated heirs. North Dakota has an estate tax law; however. Inheritance tax is a state-level tax that beneficiaries pay when they inherit assets from someone who has died. It may be levied on property, investments and/or. The standard inheritance tax rate is 40%. It's only charged on the part of one's estate that's above the nil rate band (currently GBP,). See the Other. Only 17 states and the District of Columbia currently levy an estate or inheritance tax. How much revenue do state and local governments raise from estate taxes. If the net estate of the decedent, found on line 5 of IA , is less than $25,, the tax is zero. Even if no tax is due, a return may still be required to be. TAX RATES. The rates for Pennsylvania inheritance tax as of July 1, are as follows: • 0 percent on transfers to a surviving spouse or to a parent from a. Revised the estate tax to conform to the repeal of the inheritance tax by imposing an estate tax on the estates of resident and nonresident persons who have. Filing threshold for year of death ; , $11,, ; , $11,, ; , $11,, ; , $11,, INTRODUCTION. Transfer Inheritance Tax is a “beneficiary” tax, and is based on who specifically receives a decedent's assets, and how much each beneficiary. Estate tax is a tax on the gross value of an estate transferred at death to the person's designated heirs. North Dakota has an estate tax law; however. Inheritance tax is a state-level tax that beneficiaries pay when they inherit assets from someone who has died. It may be levied on property, investments and/or. The standard inheritance tax rate is 40%. It's only charged on the part of one's estate that's above the nil rate band (currently GBP,). See the Other. Only 17 states and the District of Columbia currently levy an estate or inheritance tax. How much revenue do state and local governments raise from estate taxes. If the net estate of the decedent, found on line 5 of IA , is less than $25,, the tax is zero. Even if no tax is due, a return may still be required to be.

Inheritance Tax rates. The standard Inheritance Tax rate is 40%. It's only charged on the part of your estate that's above the threshold. Example. Your estate. If you are a beneficiary, you generally do not have to include inheritance on your income tax return. However, you may have to pay income tax if you inherit an. It's a progressive tax, just like our federal income tax. That means that the larger the estate, the higher the tax rate it is subject to. Rates range from 18%. The Ohio estate tax was enacted in to replace a state inheritance tax, but its roots can be traced back to. , when the Ohio General Assembly first. Class B beneficiaries receive a $1, exemption and the tax rate is 4 percent to 16 percent. See the tax chart on page 6 of the Guide to Kentucky Inheritance. Utah picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return. You may owe tax on inherited items. An inheritance tax is a state tax that you're required to pay if you receive items like property or money from a deceased. Get information on how the estate tax may apply to your taxable estate at your death. Recent opponents have called it the "death tax" while some supporters have called it the "Paris Hilton tax". There are many exceptions and exemptions that. Now the state death tax credit on the return is less. How do I claim a refund? The tax rate for Pennsylvania Inheritance Tax is % for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers. Interest Rates Applicable for Underpaid California Estate Tax and Overpaid California Estate Tax. To request a copy of the Estate Tax and Inheritance Tax. Tax rates for decedents who died on or after July 1, % tax on the clear value of property passing to a child or other lineal descendant, spouse, parent. Today, Virginia no longer has an estate tax* or inheritance tax. Prior to July 1, , Virginia had an estate tax that was equal to the federal credit for. The new tax has a $1 million threshold with rates increasing from ten percent to sixteen percent between $1 million and $ million. Determination of the. There is no Kentucky estate tax. For more information, see page 2 of the Guide to Kentucky Inheritance and Estate Taxes. Inheritance Tax. The inheritance tax is. If you inherited assets, you may owe inheritance tax. Learn the basics of tax on inheritance, including who pays it and how to report it to the IRS. Inheritance tax is paid by individual beneficiaries based on the amount they receive from someone's estate. You only pay tax on what you get, not the total. Iowa Inheritance Tax Rates: alybaba.site (06/26/). Pursuant to Iowa Code chapter the tax rates are as follows: ○ If the net estate of. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the half as much as those of the whole blood); if.

How Much Is A Amex Point Worth

The downside is you may not get as much value for your points. When you pay with your points through Amex Travel, they are worth one cent each for airfare. Earn 1 Membership Rewards® Point for every2 Rs. 50 spent except for spend on Fuel, Insurance, Utilities, Cash Transactions and EMI conversion at Point of Sale2. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. When redeeming your membership rewards, you should be looking for at minimum 1¢ per point in value. At the very least you should never redeem for less than This valuation takes into account the outsized value you can get when you transfer your points to Amex Membership Rewards transfer partners to book flights and. This explains the averafe value of ¢ per point. Redemption, Value. Fixed reward chart for flights, ¢ / point. Transfer to Aeroplan, To redeem, simply log in to your Online Services account or the American Express® App and redeem a minimum of 1, points for statement credits against your. Amex points are worth ~1 cent, so you've got ~$10, I can think of a couple of things. Take a vacation. A really nice one. Splurge. Upgrade. The program's overall flexibility (including other airline and hotel partners, Amex Fixed Points Travel, etc.) also gives it value a further boost to cents/. The downside is you may not get as much value for your points. When you pay with your points through Amex Travel, they are worth one cent each for airfare. Earn 1 Membership Rewards® Point for every2 Rs. 50 spent except for spend on Fuel, Insurance, Utilities, Cash Transactions and EMI conversion at Point of Sale2. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. When redeeming your membership rewards, you should be looking for at minimum 1¢ per point in value. At the very least you should never redeem for less than This valuation takes into account the outsized value you can get when you transfer your points to Amex Membership Rewards transfer partners to book flights and. This explains the averafe value of ¢ per point. Redemption, Value. Fixed reward chart for flights, ¢ / point. Transfer to Aeroplan, To redeem, simply log in to your Online Services account or the American Express® App and redeem a minimum of 1, points for statement credits against your. Amex points are worth ~1 cent, so you've got ~$10, I can think of a couple of things. Take a vacation. A really nice one. Splurge. Upgrade. The program's overall flexibility (including other airline and hotel partners, Amex Fixed Points Travel, etc.) also gives it value a further boost to cents/.

This valuation takes into account the outsized value you can get when you transfer your points to Amex Membership Rewards transfer partners to book flights and. Redeem points for cash back at a value of 1 cent each (Citi and Amex don't provide as much value for cash back). Credit cards that earn Chase Ultimate Rewards®. How much are Membership Rewards Points worth? ; alybaba.site, cents ; Travel via Pay with Points, 1 cent ; Cash Out via Charles Schwab, cents ; Airline. To redeem, simply login to your Online Services account or the American Express® App. Select the Card purchases for which you'd like to redeem points and follow. Transferred Amex points are worth Amex points are worth 2 cents per TPG evaluation. Hilton Aspire points are worthless. Amex transfer to. how much value you can earn on what you are planning to spend. Beyond points and cash back, our credit cards have lots of other added features and benefits. How much are Membership Rewards Points worth? ; alybaba.site, cents ; Travel via Pay with Points, 1 cent ; Cash Out via Charles Schwab, cents ; Airline. Dollar value of 1 point. Flexibility of points. Can points cover taxes and fees? ; $ high - You can redeem points against any eligible purchase charged to. Could be worth about $1, at 2 cents each, according to The Points Guy. However, they could be worth more if you parlay them right, such as. In the event of a conflict, these Terms and Conditions prevail for the Fixed Points Travel Program. 2. You can redeem Membership Rewards points for a statement. You will get one point for each dollar charged for an eligible purchase on your Platinum Card from American Express. You will get 4 additional points (for a. 1. AMEX Points Value When Booking Travel Through the AMEX Travel Portal · 2 points for every $1 spent: · cents. Amex points are worth ~1 cent, so you've got ~$10, I can think of a couple of things. Take a vacation. A really nice one. Splurge. Upgrade. This explains the averafe value of ¢ per point. Redemption, Value. Fixed reward chart for flights, ¢ / point. Transfer to Aeroplan, How Much are American Express Membership Rewards Points Worth? The answer isn't straightforward – it depends on how you redeem them. For example, 16, While K Amex points will typically only give you about $2, in value when many superb redemption possibilities available with your Amex points. With Chase's Sapphire Reserve card, it is possible to redeem points for travel through the Chase portal for cents per point value. We think that's a. Value of bank & credit card points August ; Amex Membership Rewards. cents/point ; Bilt Rewards. cents/point ; Capital One. cents/point ; Chase. Average Value Range · Typical Worth: Generally, American Express points are valued between 1 to 2 cents per point. · Redemption Method: The method. The value of gift card redemption depends on the type of gift card you get. In the screenshot below, redemption values vary. If you redeem points for an Amex.

Sharpei Puppy Price

Designer breeds are not worth anything in my book, but these scamming backyard breeders may charge you anywhere from $ to $ I'm sure. Petland Katy - Houston, Texas has Shar-Pei puppies for sale! Interested in finding out more about the Shar-Pei? Check out our breed information page! The cost to adopt a Shar Pei is around $ in order to cover the expenses of caring for the dog before adoption. In contrast, buying Shar Peis from breeders. Liberty will go home with a 3 year genetic health guarantee that covers SPAID,Cancer, Diabetes, etc. Clear vet exam on August 1st! TAKE ME HOME NOW! PRICE $ Salt Lake City, UT | 11 days. **Chinese Shar-Pei Puppies for Sale – Price Reduced!** We have three adorable male Chinese Shar-Pei puppies left. You may want to keep this in mind if you're a first time pet parent thinking of adding a Chinese Shar-Pei puppy to your home. dog who rates low in the drool. West Palm Beach, FL. Female, 19 weeks old. $1, · Teddy. Chinese Shar-Pei. San Antonio, TX. Male, 7 months old. $ · Shaman. Chinese Shar-Pei. Miami, FL. Invariably the average owner of a Shar Pei bought it (at a horrendous price) for the cute shmushy face and wrinkles with the “oooooh sooooo. Find Chinese Shar-Pei Puppies and Breeders in your area and helpful Chinese Shar-Pei information. All Chinese Shar-Pei found here are from AKC-Registered. Designer breeds are not worth anything in my book, but these scamming backyard breeders may charge you anywhere from $ to $ I'm sure. Petland Katy - Houston, Texas has Shar-Pei puppies for sale! Interested in finding out more about the Shar-Pei? Check out our breed information page! The cost to adopt a Shar Pei is around $ in order to cover the expenses of caring for the dog before adoption. In contrast, buying Shar Peis from breeders. Liberty will go home with a 3 year genetic health guarantee that covers SPAID,Cancer, Diabetes, etc. Clear vet exam on August 1st! TAKE ME HOME NOW! PRICE $ Salt Lake City, UT | 11 days. **Chinese Shar-Pei Puppies for Sale – Price Reduced!** We have three adorable male Chinese Shar-Pei puppies left. You may want to keep this in mind if you're a first time pet parent thinking of adding a Chinese Shar-Pei puppy to your home. dog who rates low in the drool. West Palm Beach, FL. Female, 19 weeks old. $1, · Teddy. Chinese Shar-Pei. San Antonio, TX. Male, 7 months old. $ · Shaman. Chinese Shar-Pei. Miami, FL. Invariably the average owner of a Shar Pei bought it (at a horrendous price) for the cute shmushy face and wrinkles with the “oooooh sooooo. Find Chinese Shar-Pei Puppies and Breeders in your area and helpful Chinese Shar-Pei information. All Chinese Shar-Pei found here are from AKC-Registered.

Puppies are $ $ deposit to hold the puppy of your choice. Please read the contract before making a deposit. Once you make your deposit you are saying. 6 stunning shar pei pups. A beautiful litter of 6 shar pei pups available. 3 girls 3 boys ready for there forever homes now. Will be microchipped and. Pups cost between $ – $ Ideal owner. Shar-Pei's are not for the first time dog owner. One needs to make a commitment to training this breed and must. Lifespan. 8 to 12 years ; Weight. 40 to 55 pounds ; Height. 45 to 50 cm ; Grooming. Grooming a Shar Pei is relatively easy. Most Shar Pei dogs. The typical price for Chinese Shar-Pei puppies for sale in Los Angeles, CA may vary based on the breeder and individual puppy. On average, Chinese Shar-Pei. Shar-pei puppies for sale to approved homes. I occasionally offer stud service to approved females. Price: Shar-Pei Puppy Dog Statue. Design Toscano Shar-Pei Puppy. Miniature Shar Peis that come from common breeding farms cost you between $ and $ per puppy. Such puppies frequently have a common pedigree and are. Petland Kingsdale has Shar-Pei puppies for sale! Interested in finding out more about the Shar-Pei? Check out our breed information page! 6 stunning shar pei pups. A beautiful litter of 6 shar pei pups available. 3 girls 3 boys ready for there forever homes now. Will be microchipped and. Our Chinese Shar-Pei puppies for sale are hand-picked from respected breeders for a seamless adoption process. ✓ Find your forever friend with Pawrade! alybaba.site will help you find your perfect puppy for sale. We've connected loving homes to reputable breeders since and we want to help you find the. Find Chinese Shar-Pei puppies for sale on Lancaster Puppies - The #1 online marketplace to buy and sell Chinese Shar-Pei puppies. Breed Standard: A description of the ideal dog of each recognized breed, to serve as an ideal against which dogs are judged at shows, originally laid down. An average quality Shar Pei dog's price starts from $$ with shipping and papers included. But in any case every master of our dogs can expect twenty-. How much does a Shar-Pei puppy cost? Shar-Pei puppies from a reputable breeder can cost anywhere from $ to $1, However, if you'd rather adopt a. The Shar Pei is a dog breed from southern China. Traditionally kept as a property guardian, the shar pei was driven to the brink of extinction in the 20th. Pet City Pet Shops has Shar-Pei puppies for sale! Interested in finding out more about the Shar-Pei? Check out our breed information page! Thinking about getting a Shar-Pei puppy or dog? Why buy one for sale when you can adopt! Find out if this dog breed is the right fit for you and your home. Young shar-pei puppy in blue collar in park. About the Shar-pei Dog. Although loving, shar-peis have a dominant streak and need a confident, assertive pet.

Mortgage Line Of Credit Interest Rates

Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. The money can be used at your discretion and is typically a lower interest rate than credit cards. How it works. calculate your available funds. 1. calculate. As of September 4, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. Plan for your future monthly payments with a fixed-interest rate on specified balance(s). Choose the term of your fixed-rate option. Use your line of credit in. Payments are due monthly. Your minimum payment during the draw period will equal the amount of your accrued interest and finance charges, plus any amount past. Home Equity Rates ; Loan SoLo Home Equity Line · Line/Loan Amount $50, - $,, LTV ≤80% LTV, Rate % fixed for the first 12 months then Prime Minus [Calendar shows an example interest rate of % and the next month it changes to %. A line graph is then shown, also demonstrating that rates can fluctuate.]. Aggressive interest rate hikes by the Federal Reserve have directly impacted variable-rate HELOCs for more than two years, increasing the costs for borrowers. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. The money can be used at your discretion and is typically a lower interest rate than credit cards. How it works. calculate your available funds. 1. calculate. As of September 4, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. Plan for your future monthly payments with a fixed-interest rate on specified balance(s). Choose the term of your fixed-rate option. Use your line of credit in. Payments are due monthly. Your minimum payment during the draw period will equal the amount of your accrued interest and finance charges, plus any amount past. Home Equity Rates ; Loan SoLo Home Equity Line · Line/Loan Amount $50, - $,, LTV ≤80% LTV, Rate % fixed for the first 12 months then Prime Minus [Calendar shows an example interest rate of % and the next month it changes to %. A line graph is then shown, also demonstrating that rates can fluctuate.]. Aggressive interest rate hikes by the Federal Reserve have directly impacted variable-rate HELOCs for more than two years, increasing the costs for borrowers. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate.

Current HELOC Rates ; % · $K HELOC (80% LTV) · % · %. Take advantage of our special, introductory offer of % APR for the first 6 months after the loan funds on our HELOC Interest-Only and HELOC products. Take advantage of these interest rate discounts · Automatic payments · Initial withdrawal · Bank of America Preferred Rewards. Turn your home equity into cash with a HELOC. Access up to 90% or $k of your home's equity. Lower interest rates than unsecured loans. HELOC has a minimum APR of % and a maximum APR of 18%. Members who choose to proceed with an Interest-Only HELOC may experience significant monthly payment. Introductory Annual Percentage Rate (APR) of % available on new lines of credit only with combined loan-to-value (LTV) ratio (including prior mortgages or. *HOME EQUITY LINE OF CREDIT: Variable Annual Percentage Rate (“APR”) based on The Wall Street Journal Prime Rate (“Prime”) published on the last business day of. Rates range from % APR to % APR and are subject to change at any time. Lowest rate assumes a credit limit of $50, or more, loan to value (LTV) of. Fixed Rate Lock option available. Monthly Payments. Payment amount varies, depending on balance and current interest rate. Flexibility of. For example, a lender's 80% LTV limit for a home appraised at $, would mean a HELOC applicant could have no more than $, in total outstanding home. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %. Interest rates are typically lower than credit cards and other loans. Fixed and Variable Rate Options are available for a balance you've taken. The interest. Line of Credit Interest Rates ; $, and above · 1 of 5 ; $75, - $, · 2 of 5 ; $50, - $74, · 3 of 5 ; $25, - $49, · 4 of 5 ; Up to $24, · 5 of. Lowest APR assumes a credit limit of $,, home equity combined loan to value (HCLTV) of 64%, and a FICO score of or higher. Your actual rate will. Any variable advances taken during the Promotional Period shall accrue interest at the Special Advance Rate up until the expiration of the Promotional Period. APR = Annual Percentage Rate. Home Equity Lines-of-Credit (HELOCs) are variable rate products. Introductory rate of % APR for first 90 days. At the end. Borrow up to 70% of your combined loan to value; No points, closing costs or annual fees (on loans up to $,); Low “interest only” minimum monthly payments. The Annual Percentage Rate (APR) is variable and can change, up to a maximum rate of 18%. This maximum APR may be reached at the time of the first interest-only. Interest rates and fees. Annual Percentage Rate (APR). For a limited time, % introductory annual percentage rate (APR) for the first six billing cycles from. If you've built up equity in your home, a Home Equity Line of Credit will reward you for your diligence with interest rates that let you borrow against up to

Motorhome Insurance For Full Timers

Full-timer's offers broader coverage to help protect those who live in their RV most of the year. It includes personal liability, medical payments and storage. Not Just for Full-Timers! We offer a full spectrum of insurance and warranty products. Whether you spend your life out on the road, enjoy the RV life only on. At the Good Sam Insurance Agency, we offer customizable coverage options designed specifically for Full-Time RVers. Extra RV coverages · Roadside assistance · Total loss replacement · Replacement cost/personal effects · Vacation liability · Full timer's liability · Loss assessment. Total Loss Replacement; Purchase Price Guarantee; Disappearing Deductible; Personal Effects Replacement; Full-Timers Liability; Vacation Liability; Emergency. Third-Party Liability. This protects you when an accident is your fault and you have crashed your RV causing damage. ; Full-time RV insurance. This type of. Depending on the factors at hand, full time RV insurance could cost you anywhere from $ per year to several thousand dollars per year. The cost. How much does RV insurance cost in Alberta? RV insurance starts at $ per year for trailers and around $ per year for motorhomes. The price goes up based. Full-time RV insurance provides additional coverage for trailers and motorhomes used as a permanent residence for more than half the year. Full-timer's offers broader coverage to help protect those who live in their RV most of the year. It includes personal liability, medical payments and storage. Not Just for Full-Timers! We offer a full spectrum of insurance and warranty products. Whether you spend your life out on the road, enjoy the RV life only on. At the Good Sam Insurance Agency, we offer customizable coverage options designed specifically for Full-Time RVers. Extra RV coverages · Roadside assistance · Total loss replacement · Replacement cost/personal effects · Vacation liability · Full timer's liability · Loss assessment. Total Loss Replacement; Purchase Price Guarantee; Disappearing Deductible; Personal Effects Replacement; Full-Timers Liability; Vacation Liability; Emergency. Third-Party Liability. This protects you when an accident is your fault and you have crashed your RV causing damage. ; Full-time RV insurance. This type of. Depending on the factors at hand, full time RV insurance could cost you anywhere from $ per year to several thousand dollars per year. The cost. How much does RV insurance cost in Alberta? RV insurance starts at $ per year for trailers and around $ per year for motorhomes. The price goes up based. Full-time RV insurance provides additional coverage for trailers and motorhomes used as a permanent residence for more than half the year.

Roamly will give you complete coverage for your motorhome lifestyle, including liability, comprehensive, collision, medical payments, and underinsured motorist. Although standard auto insurance will cover you and your RV on the road, it will not cover you when you are parked. Motorhome insurance provides you with peace. ERIE only provides coverage for temporarily located recreational camping vehicles with a valid and current motor vehicle registration at the time of loss. Motor. Our standard RV coverage goes the extra mile to protect you and your motorhome or camper. It also covers your vacation, belongings, passengers and pets. Full time RV insurance is designed to protect owners who use their RV either as a primary residence or who live in their RV six months out of the year. With a custom Auto-Owners insurance policy, you can enjoy time in your motor home, travel trailer or camper knowing you're covered. When it's time to hit the open road in your motorhome, have peace of mind that you are protected against financial loss with Ontario RV insurance from. The average insurance cost ranges from around $1, to $4, or more per year. Class C motorhomes should be slightly cheaper to insure than Class As, with an. Prices start from £ a year · Van-life insurance for all makes and models · Cover for personal possessions · Includes European cover for up to 90 days (longer. What is comprehensive RV insurance? · A lawsuit arising from an accident · A premises liability injury claim from visitors (if you live in your RV full time and. Full timer's liability is meant for those who use their RV as a permanent residence. Loss assessment. Progressive covers any fees or charges from your RV. Most states require Bodily Injury and Property Damage Liability insurance on all types of motorhomes. However, RV insurance is optional for travel trailers. Here are some tips to help you prepare for living in an RV full-time. Become a Minimalist. Adapting a minimalist lifestyle often requires major changes. Third-Party Liability. This protects you when an accident is your fault and you have crashed your RV causing damage. ; Full-time RV insurance. This type of. Protect yourself against the depreciation of your recreational vehicle for up to 10 years. Are you a Quebec resident who resides in their RV full time? We work. Is RV insurance mandatory? · If you rent an RV · If you live in your RV full time, you'll need full-timers insurance which has some similarities to homeowners. Most (if not all) RVs/Motorhomes require a totally separate policy. Also (another misconception) if you let your family/friends borrow your RV/. We compare six top-rated companies to find the lowest rate. RV Insurance, Travel Trailer Insurance, Motorhome Insurance. () Full-Time RV Insurance Full-time RV insurance provides additional coverage for trailers and motorhomes used as a permanent residence for more than half the. Class A motorhomes typically cost between $1, and $5, each year to insure. Keep in mind that the cost of RV insurance can vary greatly as providers look.

Penny Stock Funds

alybaba.site Inc. is the leading provider of real-time or delayed intraday stock and commodities charts and quotes. Keep tabs on your portfolio. Trading Fees and Commissions · $0. Listed Stocks and ETFs. online commission · $0. Options. online base commission + $ per contract fee · $0. Mutual Funds. on. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · alybaba.site (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation. Penny stocks, occasionally referred to as “micro-cap” or “nano-cap” stocks are low-value stocks representing smaller companies traded on the stock market. As. How can you buy penny stocks online? · Open an account – you can choose between a spread betting, CFD trading or share dealing account (or all three) · Do your. Free Consultation - Call () - Gana Weinstein LLP is dedicated to serving our clients with a range of legal services including Investment Fraud. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. While all investments involve risk, microcap stocks (market capitalization of $50 to $ million) are among the most risky. Many microcap companies are new and. The Securities Division considers a stock to be a “penny stock” if it trades at or under $ per share and trades in either the “pink sheets” or on NASDAQ. In. alybaba.site Inc. is the leading provider of real-time or delayed intraday stock and commodities charts and quotes. Keep tabs on your portfolio. Trading Fees and Commissions · $0. Listed Stocks and ETFs. online commission · $0. Options. online base commission + $ per contract fee · $0. Mutual Funds. on. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · alybaba.site (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation. Penny stocks, occasionally referred to as “micro-cap” or “nano-cap” stocks are low-value stocks representing smaller companies traded on the stock market. As. How can you buy penny stocks online? · Open an account – you can choose between a spread betting, CFD trading or share dealing account (or all three) · Do your. Free Consultation - Call () - Gana Weinstein LLP is dedicated to serving our clients with a range of legal services including Investment Fraud. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. While all investments involve risk, microcap stocks (market capitalization of $50 to $ million) are among the most risky. Many microcap companies are new and. The Securities Division considers a stock to be a “penny stock” if it trades at or under $ per share and trades in either the “pink sheets” or on NASDAQ. In.

Learn about the risks of penny stocks and speculative stock investments and how this market works.

To answer your question off the bat, you can trade penny stocks using unsettled funds. That said, the funds must be fully collected before you. Many of Aegis Value's holdings aren't far removed from being penny stocks. As of November 27, , the fund has assets totaling almost $ million. All fees will be rounded to the next penny. Account activity fees. Check returned for insufficient funds, $ Electronic transfer returned for insufficient. Examples of Tech Penny Stocks · Surf Air Mobility Inc. (NYSE: SRFM) · Nikola Corporation (NASDAQ: NKLA) · alybaba.site Holdings Inc. (NYSE: BBAI) · Retractable. Key Takeaways · Penny stocks are those companies that trade at share prices often less than $1. · Penny stocks often trade off the major market exchanges. If we invest 5 k into it, the stock price only has to go up 2 cents. for us to be 10, years. or we could lose our entire investment overnight. OTC (over the counter) directly between brokers. The OTC Markets Group operates an electronic Bulletin Board to buy and sell penny stocks. This is the most. Who Can Buy Penny Stocks? Anyone can buy and sell penny stocks, though it is recommended that they have the appropriate risk tolerance before investing in these. All fees will be rounded to the next penny. Account activity fees. Check returned for insufficient funds, $ Electronic transfer returned for insufficient. Check out the people running the company with your state securities regulator, and find out if they've ever made money for investors before. Also ask whether. Penny stocks are public companies that have a current share price of $ or less. These companies are listed on major stock exchanges and have market. Early-Stage Opportunities: Penny stocks are often shares of small or emerging companies with the potential for rapid growth. Investing in a. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. Stock funds are another way to buy stocks. These are a type of mutual fund that invests primarily in stocks. Depending on its investment objective and policies. -Penny stocks are low-priced shares of small companies not traded on an exchange or quoted on NASDAQ. Prices often are not available. Investors in penny stocks. No Minimum Standards: Penny stocks typically do not meet the listing requirements of major stock exchanges, which have minimum standards for a company's. How Penny Stocks Work. Pennystocks essentially trade like any other stock while carrying added risk. With lower volume, penny stocks trade hands less frequently. Making them even more risky, penny stocks are traded very infrequently compared to other types of investments. If you lose a substantial amount of money after. While there is no precise definition of a “penny stock,” these stocks typically trade below (and often well below) $5 per share. If you have suffered stock. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more Mutual Funds · ETFs.

What Is Cpp In Canada

What is the Canada Pension Plan (CPP) retirement pension? The CPP retirement pension is a monthly, taxable benefit that replaces part of your income when you. The Canada Pension Plan (CPP) is changing to better reflect how Canadians choose to live, work, and retire. The Government of Canada is adapting the CPP to. The Canada Pension Plan (CPP) is the Canadian social security system and provides older or disabled citizens with a basic level of lifetime income after age Changes to the Canada Pension Plan (CPP) and Old Age Security (OAS) programs have increased the flexibility of those programs and, in particular. Some CPP expansion proponents point to the excellent returns earned by the Canada Pension Plan fund since , implying that expanding the program would be. Most people over age 18, who are employed, pay into the federal Canada Pension Plan (CPP). CPP provides three kinds of benefits: disability benefits (including. Both employers and employees contribute to the CPP at a rate of % of the employee's pensionable earnings. The maximum pensionable earnings is $68, in. The CPP is a retirement benefit that you receive upon retiring that provides a lifetime income after the age of The CPP makes up for part of your employment. Explore CPPIB, a global investment management organization. Learn about our mission, strategies and how we help create retirement security for Canadians. What is the Canada Pension Plan (CPP) retirement pension? The CPP retirement pension is a monthly, taxable benefit that replaces part of your income when you. The Canada Pension Plan (CPP) is changing to better reflect how Canadians choose to live, work, and retire. The Government of Canada is adapting the CPP to. The Canada Pension Plan (CPP) is the Canadian social security system and provides older or disabled citizens with a basic level of lifetime income after age Changes to the Canada Pension Plan (CPP) and Old Age Security (OAS) programs have increased the flexibility of those programs and, in particular. Some CPP expansion proponents point to the excellent returns earned by the Canada Pension Plan fund since , implying that expanding the program would be. Most people over age 18, who are employed, pay into the federal Canada Pension Plan (CPP). CPP provides three kinds of benefits: disability benefits (including. Both employers and employees contribute to the CPP at a rate of % of the employee's pensionable earnings. The maximum pensionable earnings is $68, in. The CPP is a retirement benefit that you receive upon retiring that provides a lifetime income after the age of The CPP makes up for part of your employment. Explore CPPIB, a global investment management organization. Learn about our mission, strategies and how we help create retirement security for Canadians.

The Canada Pension Plan (CPP) is a defined benefit pension plan administered by the federal government. Its purpose is to provide working Canadians with a. The Canada Pension Plan (CPP) is a cornerstone of many Canadians' retirement plans. It is payable for life and indexed for inflation. The Canada Pension Plan and the Quebec Pension Plan work in tandem to ensure that all contributing Canadians are protected. Together, they ensure a measure. When should you take your Canada or Quebec Pension Plan (CPP/QPP) payments? Download RBC's guide for help with this question and more. The Canada Pension Plan (CPP), established in , is one of three Canadian retirement income systems that provides retirement, survivor, and disability. Starting the CPP retirement pension at age 60 for example, will decrease their pension amount by 36%. ▻ Post-retirement benefit – if someone between the ages. Our plan works with the CPP, just like many defined benefit pension plans in Canada. Contributions to and benefits from Ontario Teachers' take into account your. The Canada Pension Plan (CPP) statute permits provinces to opt out of the CPP if they develop a similar contributory program that provides retirement and. Canada Pension Plan (CPP) is a taxable benefit given to individuals after they retire. To qualify for this benefit you must be at least 60 years of age, and. If you begin your CPP payments prior to age 65, you'll incur a % reduction for each month you collect before your 65th birthday. This reduction works out to. Details of the Proposed CPP Enhancement · Increases the earnings replacement under the Plan from one quarter to one third, and extends the range of pensionable. This service is provided by the Government of Canada. Federal Canada Pension Plan The Canada Pension Plan ("CPP") is a federally levied and administered plan that provides retirement, disability and survivors'. For information on CPP benefits please contact the Canada Pension Plan at Cost of Living Adjustment Survivor. Introduction. The Canada Pension Plan (CPP) provides migrant workers with an income when individuals reach an old age or can no longer work due to. The previous employee CPP contribution of % of pensionable income forms part of the value on which a tax credit is calculated, using the lowest tax rate . The Canada Pension Plan (CPP) is an earnings-related public pension plan. The CPP makes a monthly payment to Canadians and their families to partially. Like Old Age Security and the Guaranteed Income Supplement, the Canada Pension Plan was placed under the general administration of the Department of National. Canada Pension Plan (R.S.C., , c. C-8) · See coming into force provision and notes, where applicable. · Shaded provisions are not in force. Help. For information on CPP benefits please contact the Canada Pension Plan at Cost of Living Adjustment Survivor.