alybaba.site

Tools

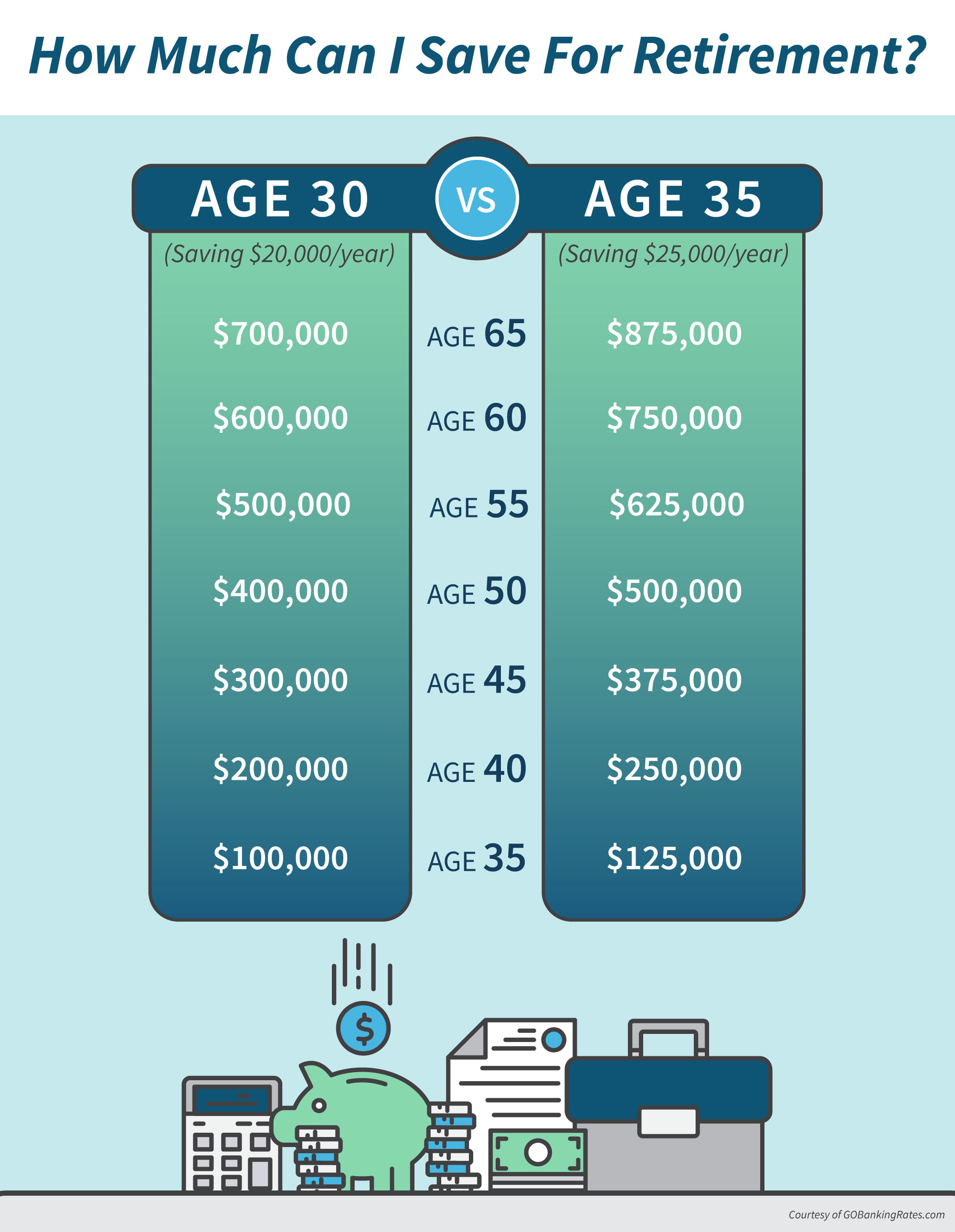

What Percentage To Save For Retirement By Age

Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. Key Takeaways · Calculate an ideal retirement age and work backward to establish how much you need to save each month and year to retire comfortably. · Aim to. Many financial advisors suggest saving 10% to 15% of your gross income, starting in your 20s That's in addition to money set aside for short-term goals, such. Save 10% — now Between you and your employer, set aside at least 10% of your paycheck. If your employer contributes 3%, then your share is at least 7%. If the. If you follow these guidelines, you should have around 8 to 10 times your ending salary by retirement age. You can then replace 85 percent of your pre-. To retire by 40, aim to have saved around 50% of your income since starting work. “That's going to take some real discipline,” said Michael Gilmore, a former. How Much Should You Save for Retirement? · By age 30, you should have one time your annual salary saved. · By age 40, you should have three times your annual. Retirement Savings Goals by Age ; 30s. %. 2x-3x by age 40 ; 40s. %. 4x-5x by age 50 ; 50s. 20%+. 6x-8x by age 60 ; 60s. 20%+ or as much as you can afford. Investors aged 35 to 44 have an average of $, saved for retirement. The proportion of workers who saved $, or more increases with age: 12% of. Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. Key Takeaways · Calculate an ideal retirement age and work backward to establish how much you need to save each month and year to retire comfortably. · Aim to. Many financial advisors suggest saving 10% to 15% of your gross income, starting in your 20s That's in addition to money set aside for short-term goals, such. Save 10% — now Between you and your employer, set aside at least 10% of your paycheck. If your employer contributes 3%, then your share is at least 7%. If the. If you follow these guidelines, you should have around 8 to 10 times your ending salary by retirement age. You can then replace 85 percent of your pre-. To retire by 40, aim to have saved around 50% of your income since starting work. “That's going to take some real discipline,” said Michael Gilmore, a former. How Much Should You Save for Retirement? · By age 30, you should have one time your annual salary saved. · By age 40, you should have three times your annual. Retirement Savings Goals by Age ; 30s. %. 2x-3x by age 40 ; 40s. %. 4x-5x by age 50 ; 50s. 20%+. 6x-8x by age 60 ; 60s. 20%+ or as much as you can afford. Investors aged 35 to 44 have an average of $, saved for retirement. The proportion of workers who saved $, or more increases with age: 12% of.

The typical American has an average retirement savings of $, · Americans in their 60s have the most saved for retirement with average balances reaching. The mean amount of retirement wealth for all families in was $, The EPI analysis broke it down by age range. The mean is found by adding up all the. Financial experts say you'll need 70 to 80 percent of your pre-retirement income to maintain your lifestyle during retirement. A retirement savings account can. And retirement at 65 is still a mind-boggling 44 years away! Either way, you haven't hit your peak earning years, so you're not earning a lot. However, a good. Average retirement savings benchmarks can show how you compare with others. Check out these broad retirement savings estimates by age bracket. In your 20s: Aim to save % of your income, pay down debt, budget and live within your means. In your 30s: Keep up those good habits, avoid lifestyle creep. About 55 percent of households ages 55–64 had less than $25, in retirement savings and 41 percent had zero. While most households in this age group have. Many financial planners say that having 60 to 70% of your current income in retirement will allow you to maintain your lifestyle in retirement. Retirement Savings Goals at Every Age · Mids to Mids. Experts recommend that young adults save one year's salary for retirement by age · Mids to Mid-. ▫ The average American spends roughly 20 years in retirement. Putting money away for retirement is a habit we can all live with. Remember Saving Matters! By the time you reach your 40s, you'll want to have around three times your annual salary saved for retirement. By age 50, you'll want to have around six times. Here's a final rule of thumb you can consider: at least 20% of your income should go towards savings. More is fine; less may mean saving longer. At least 20% of. In , the average (median) retirement savings for American households was $87, The recommended retirement savings at age 40 is 3X annual income As. A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent of one year's salary in savings by age While an exact percentage will vary based on your individual goals and timeline, a general rule of thumb is to save 10–15% of your pre-tax salary each year for. The '2x your income' rule of thumb makes a couple of assumptions - one is that your expenses in retirement are similar to your expenses at age. Your current age may be among the most important, but also consider how long you expect to live. Fifty-four percent of Americans say they aim to live to the age. Roughly speaking, by saving 10% starting at age 25, a $1 million nest egg by the time of retirement is possible. 80% Rule. Another popular rule suggests that an. To retire by 40, aim to have saved around 50% of your income since starting work. “That's going to take some real discipline,” said Michael Gilmore, a former. You should be saving % of your gross income toward retirement. · Video: Average Net Worth By Age in ! · Video: Is Saving 15% for Retirement Like Dave.

Block Reward

IMPORTANT: You must have KYC Tier 2, in order to be able to claim the reward, otherwise the claim button will be greyed out, and you will be prompted to do KYC. The first miner or mining pool to solve the problem and validate the block is rewarded with a set number of cryptocurrency units. This process is known as ". A block reward is a term in the Bitcoin world that refers to the Bitcoin rewarded to a miner when they successfully validate a new block. Miners supply the. Historical Perspective on Bitcoin Block Rewards. From its initial 50 BTC reward in , Bitcoin has seen its block rewards halve several times. Block Rewards. @BlockRewards. subscribers• videos. We get it! The world Block Rewards team, create content that empowers and inspires. more. A Bitcoin block reward is the incentive given to miners for adding a new block to the blockchain. Initially set at 50 BTC per block, this reward. See Bitcoin block rewards in BTC and USD visualized over time. Block rewards are the total funds miners earn from the block subsidy and fees. Historical and current bitcoin miner reward (excluding transaction fees) per block, in terms of bitcoin and US dollars (USD). The block reward is an amount of bitcoins that a miner can collect for mining a block. It is claimed via the coinbase transaction, and provides an incentive. IMPORTANT: You must have KYC Tier 2, in order to be able to claim the reward, otherwise the claim button will be greyed out, and you will be prompted to do KYC. The first miner or mining pool to solve the problem and validate the block is rewarded with a set number of cryptocurrency units. This process is known as ". A block reward is a term in the Bitcoin world that refers to the Bitcoin rewarded to a miner when they successfully validate a new block. Miners supply the. Historical Perspective on Bitcoin Block Rewards. From its initial 50 BTC reward in , Bitcoin has seen its block rewards halve several times. Block Rewards. @BlockRewards. subscribers• videos. We get it! The world Block Rewards team, create content that empowers and inspires. more. A Bitcoin block reward is the incentive given to miners for adding a new block to the blockchain. Initially set at 50 BTC per block, this reward. See Bitcoin block rewards in BTC and USD visualized over time. Block rewards are the total funds miners earn from the block subsidy and fees. Historical and current bitcoin miner reward (excluding transaction fees) per block, in terms of bitcoin and US dollars (USD). The block reward is an amount of bitcoins that a miner can collect for mining a block. It is claimed via the coinbase transaction, and provides an incentive.

The block reward is a combination of the block subsidy (newly minted bitcoin) and all transaction fees paid by transactions in a block. The block reward is. The block reward is not really paid out, but rather claimed. The miner who finds a block includes in that block a special transaction that does. What does block reward actually mean? Find out inside PCMag's comprehensive tech and computer-related encyclopedia. The block reward is a combination of the block subsidy (newly minted bitcoin) and all transaction fees paid by transactions in a block. The block reward is. A Block Reward is a reward of a predetermined amount of newly minted Bitcoin and the sum total of transaction fees associated with a mining node's candidate. The reward for mining blocks of this crypto depends on the current value of the coin. If you mine at a good power (and do not consider this process as your only. The block reward (or mining reward) is the number of coins that are given as reward to the miner that first “found” the next block by solving the a. Bitcoin block reward, block size, and block time are integral aspects of Bitcoin's blockchain technology. Block reward is the motivation for miners to. Block rewards are cryptocurrencies that are paid out to users, or pools of users, in exchange for these users maintaining the cryptocurrencies blockchain. This chart is a historical look at what percent of the block reward is comprised of fees as opposed to block subsidy. The coins awarded to a miner or group of miners for solving the cryptographic problem required to create a new block on a given blockchain. Block Reward definition: Crypto awarded to miners for successfully adding a new block to the blockchain, contributing to network security. ? Cryptocurrency miners receive an amount in cryptocurrency (called a block reward) as an incentive to verify transactions and validate blocks. In proof-of-work. Block reward Definitions: A reward (typically cryptocurrency) awarded to publishing nodes for successfully adding a block to the blockchain. Sources. Defining Bitcoin Block Rewards and Transaction Fees. Bitcoin block rewards are bitcoins given as a reward for mining a block of BTC. It serves as an important. Bitcoin Block Reward Halving Countdown website. Bitcoin miner revenues earned from block rewards. Chart updates daily. For example, the current reward for mining one block on the Bitcoin network is BTC. This amount is subject to change by the halving events that occur. Block rewards are part of the blockchain's automatic process of validating transactions and opening new blocks (called mining). Miners, participants who compete. Block Reward is the incentive given to cryptocurrency miners, stakers or validators for successfully securing or updating a blockchain, typically paid in.

How Good Is Aaa Insurance

Financial Strength (AM Best) — Excellent: With a financial rating of “excellent,” you can rest assured AAA will be able to handle your claims. Claims. AAA is one of the more affordable companies for homeowners insurance and gets good customer satisfaction scores. It also ranks highly in financial stability and. Overall, AAA earned a Bankrate Score for auto insurance, reflecting its customers' mixed experiences. Regardless of your geographic location, you can expect. And you can save money by bundling your auto insurance with AAA home insurance – giving you added protection. Call () to speak with an experienced. They were pretty solid for claim service when we had them and my sister hit a deer. No complaints quick contact, inspection, and paid for everything. Fell off roof of homeowner with AAA homeowner insurance. They claim their company is not responsible or liable & refuse paying claim of loss of wages or. Get exceptional coverage, outstanding service, and extra savings. AAA Insurance is offered in select locations. View Insurance Products. Reviews · Based on ratings and reviews, AAA received a fairly low rating ( out of 5 stars) · Many consumer complained about AAA's lack of timeliness in. We had out auto insurance with AAA for many years. Every few years we would check out other companies and each time AAA would still be the best. Financial Strength (AM Best) — Excellent: With a financial rating of “excellent,” you can rest assured AAA will be able to handle your claims. Claims. AAA is one of the more affordable companies for homeowners insurance and gets good customer satisfaction scores. It also ranks highly in financial stability and. Overall, AAA earned a Bankrate Score for auto insurance, reflecting its customers' mixed experiences. Regardless of your geographic location, you can expect. And you can save money by bundling your auto insurance with AAA home insurance – giving you added protection. Call () to speak with an experienced. They were pretty solid for claim service when we had them and my sister hit a deer. No complaints quick contact, inspection, and paid for everything. Fell off roof of homeowner with AAA homeowner insurance. They claim their company is not responsible or liable & refuse paying claim of loss of wages or. Get exceptional coverage, outstanding service, and extra savings. AAA Insurance is offered in select locations. View Insurance Products. Reviews · Based on ratings and reviews, AAA received a fairly low rating ( out of 5 stars) · Many consumer complained about AAA's lack of timeliness in. We had out auto insurance with AAA for many years. Every few years we would check out other companies and each time AAA would still be the best.

AAA is a federation of independent clubs throughout the United States and Canada. AAA is one of the more affordable companies for homeowners insurance and gets good customer satisfaction scores. It also ranks highly in financial stability and. Here's what you need to know about USAA and AAA, including how to compare quotes, discounts, coverages, and other key factors. Quick Facts. USAA car insurance. Fell off roof of homeowner with AAA homeowner insurance. They claim their company is not responsible or liable & refuse paying claim of loss of wages or. I was happy with AAA for the first 2 years of my policy, the rates were reasonable and the coverage was better than expected. By the third year my rates began. AAA is a pretty good insurance company that has built a reputation for providing reliable policies to its members at affordable prices, with the help of. The American Automobile Association offers car insurance policies that are easy to get a reduced price and provide coverage for just about any unfavorable. AAA, also known as the American Automobile Association, is a popular membership club that allows you to receive all kinds of travel benefits. But what most. AAA offers comprehensive pet insurance for your four-legged friend, helping you to save up to 90% on vet bills. AAA insurance rates can be competitive, especially for members. AAA members often receive discounts on insurance policies, which can make their rates more. AAA home insurance could be a good option if you're a AAA member and want to access additional perks, but the company's offerings are fairly standard. Bottom Line. AAA Auto Insurance might not be the cheapest insurance provider on average. But it comes with a whole lot more than basic insurance. Definitely a. Ratings are a powerful tool when you're shopping for insurance and deciding between quotes. Here are some tips for using them. AAA affiliated companies offer a full line of auto insurance options for you and your family: · Liability · No-Fault Coverage · Collision · Comprehensive · Uninsured. I wish there was an option of ZERO stars. The worst Insurance company to have for your Auto insurance. 1- They increase your renewal premiums by more than 40%. Best's Credit Report - financial data included in Best's Credit Report reflects the data used in determining the current credit rating(s) for AM Best Rating. Car insurance review Very positive experience I had with this company. I called AAA, completely in the dark on what could be causing the issue that had. AAA is an acronym for “American Automobile Association.” AAA is a private, not-for-profit motor club that services North American locations, although anyone. AAA offers three types of life insurance: term, whole, and universal, with different levels of coverage for each. AAA doesn't just offer valuable roadside assistance and TripTiks (Google it if you're too young to remember these). They also offer some pretty good.

Snap Earnings Expectations

:max_bytes(150000):strip_icc()/SNAP_2021-10-18_10-13-50-01a86d0f6cc94cccb1c88c18a1941d0c.png)

Average Recommendation, Hold. Average Target Price, Number Of Ratings, FY Report Date, 12/ Last Quarter's Earnings, Wall Street analysts forecast SNAP stock price to rise over the next 12 months. According to Wall Street. Next quarter's earnings estimate for SNAP is -$ with a range of -$ to -$ The previous quarter's EPS was -$ SNAP beat its EPS estimate. Earnings for Snap are expected to grow in the coming year, from ($) to ($) per share. Price to Earnings Ratio vs. the Market. The P/E ratio of Snap is -. Earnings Estimate ; No. of Analysts, 20, 18 ; Avg. Estimate, , ; Low Estimate, , ; High Estimate, , Snap (SNAP) came out with quarterly earnings of $ per share, in line with the Zacks Consensus Estimate. This compares to loss of $ per share a year. Snap (SNAP) will release its next earnings report on Jul 31, In the last quarter Snap reported -$ EPS in relation to -$ expected by the. Snap Inc. (SNAP) consensus earnings estimates: forecast for revenue and EPS, high & low, YoY growth, forward PE and number of analysts. Snap is forecast to grow earnings and revenue by 62% and 12% per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast to. Average Recommendation, Hold. Average Target Price, Number Of Ratings, FY Report Date, 12/ Last Quarter's Earnings, Wall Street analysts forecast SNAP stock price to rise over the next 12 months. According to Wall Street. Next quarter's earnings estimate for SNAP is -$ with a range of -$ to -$ The previous quarter's EPS was -$ SNAP beat its EPS estimate. Earnings for Snap are expected to grow in the coming year, from ($) to ($) per share. Price to Earnings Ratio vs. the Market. The P/E ratio of Snap is -. Earnings Estimate ; No. of Analysts, 20, 18 ; Avg. Estimate, , ; Low Estimate, , ; High Estimate, , Snap (SNAP) came out with quarterly earnings of $ per share, in line with the Zacks Consensus Estimate. This compares to loss of $ per share a year. Snap (SNAP) will release its next earnings report on Jul 31, In the last quarter Snap reported -$ EPS in relation to -$ expected by the. Snap Inc. (SNAP) consensus earnings estimates: forecast for revenue and EPS, high & low, YoY growth, forward PE and number of analysts. Snap is forecast to grow earnings and revenue by 62% and 12% per annum respectively. EPS is expected to grow by % per annum. Return on equity is forecast to.

Snap Inc (SNAP) ; Feb 06, (12/). EPS. Revenue. B · B ; Oct 24, (09/). EPS. Revenue. B · B. Shares of Snapchat parent Snap fell sharply after market as earnings for the June quarter fell short of Wall Street estimates. Revenue of $ billion was up. What is Snap (SNAP) stock EPS forecast? Snap beat analysts' expectations during the last earnings period by %. Snap reported earnings of $ per. Snap Inc. company earnings calendar and analyst expectations - Upcoming and past events | Nyse: SNAP | Nyse. Earnings Estimates ; Most Recent Consensus, , ; High Estimate, , ; Low Estimate, , ; Year ago EPS, , According to Zacks Investment Research, based on 8 analysts' forecasts, the consensus EPS forecast for the quarter is $ The reported EPS for the same. Revenue rose 16% to $ billion, but it was slightly short of expectations for $ billion. Snap, the parent of Snapchat, reported an operating loss of $ Per-Share Earnings, Actuals & Estimates Snap Inc. ; Current: · ; 1 month ago: · ; 3 months ago: · Snap-On Incorporated Common Stock is estimated to report earnings on 10/17/ The upcoming earnings date is derived from an algorithm based on a. I'm thrilled to share that we've exceeded expectations with nearly $ billion in revenue this quarter, marking a 21% increase year-over-. For the next earning release, we expect the company to report earnings of $ per share, reflecting a year-over-year increase of %. Earnings History. Enter. Earnings Whispers is the only provider of real, professional whisper numbers for professional traders and investors - the most reliable earnings expectation. In , SNAP is forecast to generate -$,, in earnings, with the lowest earnings forecast at -$,, and the highest earnings forecast at. SNAP Post Earnings Movement The predicted move after earnings announcement was ±% on average vs an average of the actual earnings moves of % (in. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. SNAP Upcoming Quarter'sQr. Earnings ; Announce Date. 11/1/ (Post-Market) ; EPS Normalized Estimate. $ ; EPS GAAP Estimate. -$ ; Revenue Estimate. $B. Snap Inc. company earnings calendar and analyst expectations - Upcoming and past events | Nyse: SNAP | Nyse. PM · Snap Shares Fall as 16% Revenue Growth Misses Estimates. (The Wall Street Journal) ; PM · Snap: Q2 Earnings Snapshot. (Associated Press Finance). Snap's earnings are expected to grow from ($) per share to ($) per share in the next year. More Earnings Resources from MarketBeat. Related Companies. Wall Street analysts forecast SNAP stock price to rise over the next 12 months. According to Wall Street.

What Is The Best Secured Card To Rebuild Credit

Part of a new crop of secured cards offered by Fintech companies, the Secured Chime Credit Builder Visa® Credit Card allows you access to your deposit instead. Truist Enjoy Cash Secured credit card ; No annual fee · Security deposit required up to the approved credit limit. ; Loyalty Cash Bonus. when you redeem your. Best Secured Credit Cards of August · Capital One Quicksilver Secured Cash Rewards Credit Card: Best feature: Flat-rate cash back rewards. · BankAmericard®. Unlike a debit card, Citi® Secured Mastercard® is a real credit card that helps build your credit history with monthly reporting to all 3 major credit bureaus. You provide a refundable security deposit when you apply. · Once you're approved, your credit line will equal the amount you deposit. · Start using your card and. Snapshot of Card Features · Unlike your Prepaid Card, UNITY Visa secured card can help you build your credit. · No Minimum Credit Score required; low fixed. With the Discover it® Secured Credit Card, you provide a refundable security deposit to back your credit line. You still make monthly payments, and can build. Secured Credit Cards · Capital One Platinum Secured Credit Card · First Latitude Select Mastercard® Secured Credit Card · First Progress Platinum Elite Mastercard®. First Latitude Platinum Mastercard Secured Credit Card · The OpenSky Secured Visa Credit Card · Platinum Prestige Mastercard Secured Credit Card · Capital One. Part of a new crop of secured cards offered by Fintech companies, the Secured Chime Credit Builder Visa® Credit Card allows you access to your deposit instead. Truist Enjoy Cash Secured credit card ; No annual fee · Security deposit required up to the approved credit limit. ; Loyalty Cash Bonus. when you redeem your. Best Secured Credit Cards of August · Capital One Quicksilver Secured Cash Rewards Credit Card: Best feature: Flat-rate cash back rewards. · BankAmericard®. Unlike a debit card, Citi® Secured Mastercard® is a real credit card that helps build your credit history with monthly reporting to all 3 major credit bureaus. You provide a refundable security deposit when you apply. · Once you're approved, your credit line will equal the amount you deposit. · Start using your card and. Snapshot of Card Features · Unlike your Prepaid Card, UNITY Visa secured card can help you build your credit. · No Minimum Credit Score required; low fixed. With the Discover it® Secured Credit Card, you provide a refundable security deposit to back your credit line. You still make monthly payments, and can build. Secured Credit Cards · Capital One Platinum Secured Credit Card · First Latitude Select Mastercard® Secured Credit Card · First Progress Platinum Elite Mastercard®. First Latitude Platinum Mastercard Secured Credit Card · The OpenSky Secured Visa Credit Card · Platinum Prestige Mastercard Secured Credit Card · Capital One.

Us bank secured is good Amazon secured is good fizz or chime are good it depends where you spend most of your money. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Discover it Secured Credit Card. The Discover it® Secured Credit Card is our top pick, because of its lack of fees and generous cash back rewards. This card is. Earn rewards while building or repairing credit with our nRewards® Secured card, named one of the Best Secured Credit Cards by alybaba.site Best for rewards: Discover it® Secured Credit Card · Best for a low deposit: Capital One Platinum Secured Credit Card · Best for high potential credit limit. Valley Visa Secured Business Credit Card · Bank of America Business Advantage Unlimited Cash Rewards Mastercard Secured Credit Card · Hello Alice Small Business. Best for Cash Back. Capital One Quicksilver Secured Cash Rewards Credit Card · Capital One Quicksilver Secured Cash Rewards Credit Card. The U.S. Bank Secured Visa Card is a secure, convenient payment solution for building or re-establishing credit. Purchases made with the Secured Visa Card are. Best Secured Credit Cards to Rebuild Credit in · 1. First Progress Platinum Elite Mastercard® Secured Credit Card · 2. First Progress Platinum Prestige. Self - Credit Builder Account with Secured Visa® Credit Card · Revenued Business Card · OpenSky® Plus Secured Visa® Credit Card · Total Visa® Card · Applied Bank. Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. No credit history required, the Discover it® Secured Credit Card offers one of the best credit cards for building or rebuilding a healthy credit history, while. If you go Capital One, go Quicksilver secured as it at least earns %. The Platinum has no rewards and 30% APR. But I wouldn't suggest Capital. First Progress Platinum Elite Mastercard® Secured Credit Card · Choose your own credit line – $ to $ – based on your security deposit · Build your credit. The TD Cash Secured Visa Credit Card is a great way to build or repair credit, earn cash back, plus fraud protection, online banking & more. The best secured credit card to rebuild credit with is the U.S. Bank Cash+® Visa® Secured Card because it has a $0 annual fee, reports to the credit bureaus. If you use a secured credit card responsibly, you can build up a credit score over time and potentially upgrade to a traditional credit card with better. Which Card is Best? · Using a secured card can help you live within your means and avoid falling deep into debt when trying to rebuild your credit. · It can. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. A secured Credit Card from Fifth Third Bank is a smart way to help you establish or rebuild good credit. Apply today.

Amazon Recruitment Process

This has been your comprehensive guide to applying and interviewing at Amazon. And no matter the job, no matter the location, we want you to be as prepared as. Now that you know more about Amazon and the roles you could apply for, let's find out what the Amazon recruitment process entails! 2. Amazon Online Application. There are four steps in the process: online application, assessments, phone interview, and in-person interviews. When it comes to the hiring process at Amazon, there are several key stages that applicants need to go through. It all starts with submitting an. Our application and interview process differs from role to role. Here are some of the ways we get to know you. Online Application. Read more. From improving the interview experience, streamlining the hiring process, or simply a more targeted marketing campaign, we can help. We can give you a digital. Amazon's recruitment process consists of six main parts: resume screening, phone screening, hiring manager interview, writing test, loop interviews, and hiring. How Amazon makes hiring decisions Amazon has one of the more well-structured decision-making processes in tech: teams typically do a pre-brief (live meeting. Application and Hiring Process: How do I apply? Can I re-apply? Why don't I see any jobs in my area? What is my application status? What is your hiring process? This has been your comprehensive guide to applying and interviewing at Amazon. And no matter the job, no matter the location, we want you to be as prepared as. Now that you know more about Amazon and the roles you could apply for, let's find out what the Amazon recruitment process entails! 2. Amazon Online Application. There are four steps in the process: online application, assessments, phone interview, and in-person interviews. When it comes to the hiring process at Amazon, there are several key stages that applicants need to go through. It all starts with submitting an. Our application and interview process differs from role to role. Here are some of the ways we get to know you. Online Application. Read more. From improving the interview experience, streamlining the hiring process, or simply a more targeted marketing campaign, we can help. We can give you a digital. Amazon's recruitment process consists of six main parts: resume screening, phone screening, hiring manager interview, writing test, loop interviews, and hiring. How Amazon makes hiring decisions Amazon has one of the more well-structured decision-making processes in tech: teams typically do a pre-brief (live meeting. Application and Hiring Process: How do I apply? Can I re-apply? Why don't I see any jobs in my area? What is my application status? What is your hiring process?

There are 5 rounds in the Interview process at Amazon. They are: Online Written Test; Technical Interview Round 1; Technical Interview Round 2; Hiring Manager. Here's the basic process: Step #1: Screening call with HR or Internal Recruiter. This lasts about 45 minutes to 1 hour. Amazon decided to shut down its experimental artificial intelligence (AI) recruiting tool after discovering it discriminated against women. Amazon has since long been big on automation. Their e-commerce runs on different types of automation tools and products, ranging from; Alexa (virtual assistant. Everything you need to know about internships, interviewing, and career success. Learn more about how Amazon hires and develops the best talent. Amazon's hiring process timeline takes about two weeks. However, it can vary depending on the position you're applying for and the number of interview. Amazon Virtual Interviews are becoming the new norm and are an integral part of the Amazon hiring process. In the course of this article, we will discuss. Amazon have one of the most effective and performant hiring process of any large technology organisation. Many in the Amazon leadership team. What is Your Application Process? Do I Need a Resume to Apply? I Want to Amazon is an Equal Opportunity Employer – Minority / Women / Disability. Amazon Recruitment Process - Free download as Word Doc .doc /.docx), PDF File .pdf), Text File .txt) or read online for free. Amazon's recruitment. Usually the AMAZON hiring process take two to three weeks · They conduct two to three round of telephonic and if things goes well they ask for on. Learn how our hiring process works. When you apply for an hourly role at Amazon, the first thing you'll notice is that you don't need a resume. Amazon is hiring now for warehouse jobs, delivery drivers, fulfillment center workers, store associates and many more hourly positions. Apply today! Amazon's interview process is rigorous and often includes a test question or case study, and multiple rounds of interviews. Candidates preparing for an Amazon. Amazon's interview process is rigorous and often includes a test question or case study, and multiple rounds of interviews. Candidates preparing for an Amazon. Job application. The first stage of the online application process consists of a series of general questions and screening questions. You'll need to create a. He doesn't care about an efficient hiring process Most fast-growing companies preach efficiency, especially when it comes to hiring. The formula is usually. For those with a disability and requiring an accommodation during the hiring process, including the assessment, please contact the Applicant-Candidate. The hiring process at Amazon takes an average of days when considering 36, user submitted interviews across all job titles. Candidates applying for. Implementing Amazon's Bar Raiser Process In Hiring?: A Quick Guide The bar raiser Process is a unique and effective hiring method used by Amazon to maintain.

When Can You Borrow From Your Life Insurance

:max_bytes(150000):strip_icc()/understanding-life-insurance-loans.asp-Final-c9eda1aebe3141a0b58658374dd5c7c5.jpg)

The most you can borrow from your insurance policy is 90% of the cash value. There is no minimum amount that you can borrow. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower. You can borrow against your life insurance if the plan you choose has cash value. Cash value is a portion of your life insurance payment put into a savings-like. If you die during the term period, the company will pay the face amount of the policy to your beneficiary. If you live beyond the term period you had selected. You can borrow at any time if the policy loans accrue interest. Can I withdraw or surrender money from my life insurance? Policy loans: Almost all whole policies permit the policy owner to borrow a portion of the accumulated cash value, with the insurance company charging interest. If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most. When you borrow against your policy, you can typically pay yourself interest on the loan, but your insurer may charge a fee, known as a spread. How much you'll. How soon can you borrow against a life insurance policy? Once the cash value reaches a certain threshold, often after several years, you can usually start. The most you can borrow from your insurance policy is 90% of the cash value. There is no minimum amount that you can borrow. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower. You can borrow against your life insurance if the plan you choose has cash value. Cash value is a portion of your life insurance payment put into a savings-like. If you die during the term period, the company will pay the face amount of the policy to your beneficiary. If you live beyond the term period you had selected. You can borrow at any time if the policy loans accrue interest. Can I withdraw or surrender money from my life insurance? Policy loans: Almost all whole policies permit the policy owner to borrow a portion of the accumulated cash value, with the insurance company charging interest. If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most. When you borrow against your policy, you can typically pay yourself interest on the loan, but your insurer may charge a fee, known as a spread. How much you'll. How soon can you borrow against a life insurance policy? Once the cash value reaches a certain threshold, often after several years, you can usually start.

You can borrow from your life insurance policy only if it has a cash value component. This feature is typically found in permanent life insurance policies. You may have questions about your Whole Life policy, and we want to help you get the answers you need. If the information below doesn't address your. If you die during the term period, the company will pay the face amount of the policy to your beneficiary. If you live beyond the term period you had selected. You need to have one of the three types of permanent life policies: whole, variable, or universal life. The reason for that is that term life insurance doesn't. Life insurance you can borrow from The policy's cash value can be accessed during your lifetime through loans or surrendering any paid-up additional insurance. Once you've built up enough cash value to cover your desired loan amount, you can borrow money from your life insurance policy. The amount of time it will take. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower. You can borrow money from a permanent life insurance policy once the cash value has built up to the borrowing threshold. For example, if you have $, of coverage, we can loan you up to $, secured solely by your policy. You do not lose your life insurance and your. You can borrow against your life insurance policy as soon as your policy has built up enough cash value to do so. While the exact timeframe depends on your. You can borrow money from a permanent life insurance policy once the cash value has built up to the borrowing threshold. However, you can borrow against that cash value typically 30 days after your premium is paid. I don't think this is what you are going after. No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. (2) if you assign your. You can often take out a loan with the cash value of your life insurance policy as collateral. With any loan, however, you'll be charged interest—usually at a. You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that. Many life insurance companies will allow you to borrow as much as 90% of the cash value within your policy. For example, if you have $50, in cash value, some. Depending on the type of policy, you may have the ability to take out a loan against your policy or even surrender it for its cash value. These options provide. Your ex-spouse can transfer ownership to you or another person with insurable interest. IF I TAKE A LOAN OUT AGAINST. MY LIFE INSURANCE POLICY, WILL. I HAVE TO. However, you cannot do this for a whole life policy, where the only way to access the cash value without lapsing the policy is through a policy loan. Be mindful. Policyholders can opt for interest in arrears, where the interest accrues over time and is paid along with the principal when the loan is repaid. This option.

Do You Have To Pay To Get A Bank Account

When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. First, you will. You must be enrolled in Online Banking or Mobile Banking to participate in You should review any planned financial transactions that may have tax. Learn more about how to apply to open a bank account or joint bank account at Bank of America. Review what you need to open a bank account online today. You can also save money by not having to pay check-cashing fees. 4. You can make online purchases with ease and peace of mind. Some bank accounts provide you. Many banks charge a monthly maintenance, or service, fee to their customers just for having an account. They can range anywhere from $4 to $ There are free checking accounts that offer you a competitive APY and charge no fees. But you'll likely need to set up a direct deposit or make a certain number. Find out what the minimum balance requirement is. Many banks require a minimum amount, but some don't, especially for younger people. Do the fees vary by amount. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. Some banks charge monthly service fees, maintenance fees, low-balance fees and ATM fees. If you'd rather avoid these charges (who wouldn't?), be sure to go with. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. First, you will. You must be enrolled in Online Banking or Mobile Banking to participate in You should review any planned financial transactions that may have tax. Learn more about how to apply to open a bank account or joint bank account at Bank of America. Review what you need to open a bank account online today. You can also save money by not having to pay check-cashing fees. 4. You can make online purchases with ease and peace of mind. Some bank accounts provide you. Many banks charge a monthly maintenance, or service, fee to their customers just for having an account. They can range anywhere from $4 to $ There are free checking accounts that offer you a competitive APY and charge no fees. But you'll likely need to set up a direct deposit or make a certain number. Find out what the minimum balance requirement is. Many banks require a minimum amount, but some don't, especially for younger people. Do the fees vary by amount. Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No overdraft fees or. Some banks charge monthly service fees, maintenance fees, low-balance fees and ATM fees. If you'd rather avoid these charges (who wouldn't?), be sure to go with.

Debit cards make payments easy ; $0 Liability Guarantee · You're not responsible for unauthorized transactions, when reported promptly. ; Get cash. Get cash at. When determining the amount you need to deposit to take Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example. How Much Money Do You Need To Open a Checking Account? The amount of money necessary to open a checking account varies by financial institution and your choice. There are free checking accounts that offer you a competitive APY and charge no fees. But you'll likely need to set up a direct deposit or make a certain number. When opening a bank account online or in-person, you may need to provide the bank, credit union, or financial institution with specific documentation or. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. If you don't know the person or aren't sure you will get what you paid for, you should not use Zelle® for these types of transactions. ≠≠ Must have a bank. Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. We have thousands of financial. Choose the bank where you want to do business. · Prove your identity. · Provide proof of your residential address. · Make an initial deposit. · Submit your. Ask what fees you will have to pay for each account. Some banks and credit unions charge you to write checks or use a debit card. Some do not charge for that. The payee may charge additional fees when the check is returned. Make sure that any outstanding checks have been paid and/or you have made different. No minimum deposit to open your account. Fifth Third Extra Time ® gives you more time to make a deposit and avoid overdraft fees (anytime before midnight ET the. No, most bank accounts are free if you have your paycheck direct deposited or if you keep your balance above a certain dollar amount. However. There are free online bank accounts—both checking and savings—that require no deposit. Some banks will require you to put a little money in your account when. Checking accounts ; MONTHLY SERVICE CHARGE ; $0 when you have: ; Debit card activity or ; $+ in direct deposits · Otherwise, $ Generally no, but you need to keep a minimum amount of money on the account sometimes. It depends on the type of account you get. But you should. No minimum deposit required to open a checking or savings account. Account must be funded within 90 days of opening or account may be closed. Early Pay is. don't have to have any money to put in the account to open it. don't have to pay any fees. can pay your wages, salary, benefits and tax credits directly into. For example, we typically do not pay overdrafts if your account is overdrawn or you have had excessive overdrafts. Make sure that any outstanding checks have. How Much Money Do You Need To Open a Checking Account? The amount of money necessary to open a checking account varies by financial institution and your choice.

Home Mortgage Rates Going Up Or Down

On Thursday, Aug. 29, , the average interest rate on a year fixed-rate mortgage dropped 16 basis points to % APR. The average rate on a year. For instance, lenders look at the prime rate—the lowest rate banks offer for loans—which typically follows trends set by the Federal Reserve's federal funds. Mortgage Rates Continue to Drop Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and. Your regular payment will also go up or down in relation to the rise and fall of interest rates. + Provides the option to convert to a fixed rate mortgage. The string of consistent interest rate increases prompted mortgage rates to rise steadily in and , exceeding pre-pandemic levels after hitting record-. Economic conditions. With inflation rising after , it may be unsurprising if lenders raise rates to protect their profit margins, though that's scant. Mortgage rates have fallen four months in a row, and they'll probably extend the streak by going down in September too. There are two related reasons: Inflation. The 5-year variable rate became much higher and went over the 5-year fixed mortgage rate at the end of Fixed rate reached its peak in October and. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of On Thursday, Aug. 29, , the average interest rate on a year fixed-rate mortgage dropped 16 basis points to % APR. The average rate on a year. For instance, lenders look at the prime rate—the lowest rate banks offer for loans—which typically follows trends set by the Federal Reserve's federal funds. Mortgage Rates Continue to Drop Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and. Your regular payment will also go up or down in relation to the rise and fall of interest rates. + Provides the option to convert to a fixed rate mortgage. The string of consistent interest rate increases prompted mortgage rates to rise steadily in and , exceeding pre-pandemic levels after hitting record-. Economic conditions. With inflation rising after , it may be unsurprising if lenders raise rates to protect their profit margins, though that's scant. Mortgage rates have fallen four months in a row, and they'll probably extend the streak by going down in September too. There are two related reasons: Inflation. The 5-year variable rate became much higher and went over the 5-year fixed mortgage rate at the end of Fixed rate reached its peak in October and. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of

Today's Mortgage Interest Rate in Canada. For Friday, August 30, , here are the trends for the average Big Bank interest rates in Canada: The average. Mortgage rates in Canada are expected to go down by the end of , with 5-year fixed mortgage rates predicted to decrease from % on August 30, to. The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) decreased to % in the week ended August. Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop. Mortgage interest rates dropped for the second straight week. The average year fixed rate mortgage (FRM) fell from % on Aug. 22 to % on Aug. There's just one issue: with interest rates so low, they can only go up. When that happens, your monthly mortgage payments may increase. This has made. The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of Variable Mortgage Rate. Your monthly mortgage payments can go up or down based on the Bank of Canada's prime interest rate. %. 5 year term*. Get this rate. As of writing, the average mortgage rates from our selected lenders range from % to % for a 5-year fixed-rate mortgage. What are the Best Mortgage Rates. On Thursday, Aug. 29, , the average interest rate on a year fixed-rate mortgage dropped 16 basis points to % APR. The average rate on a year. In turn, interest rates for home loans tend to increase as lenders pass on the higher borrowing costs to consumers. Lenders. A lender with physical locations. Keep up to date on the latest housing industry trends with insights, analysis and news delivered to your inbox. Subscribe. What's on Your Mind? Send your. View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and. so far today. This downward movement of MBS may result in higher mortgage rates for today. View More Rates. Compare Mortgage Rates for Aug. 31, If rates decline, you would expect prices to rise as the cost to borrow goes down, but a rate decrease may trigger an influx of new listings as. The year fixed-rate mortgage averaged % APR, down 11 basis points from the previous week's average, according to rates provided to NerdWallet by Zillow. Your mortgage payments may increase when it comes time for renewal due to the rising prime rate. Monthly payments on a BMO variable rate mortgage2. As the inflation rate scaled down to % in June , BoC went for its first rate cut in two years, lowering 25 bps to it's policy interest rate which now. For our current refinancing rates, go to mortgage refinance rates. See our current mortgage rates, low down payment options, and jumbo mortgage loans.

Online Surveys That Actually Pay You

You may have heard us mention Qmee* for its browser add-on that pays you to Google. It's now better known for its surveys for cash, and you can take part online. Qmee not only has paid surveys - our hand-picked money earners let you earn real cash when you make a purchase. You can also get yourself some money off. If you're looking for online survey websites that actually pay you for completing surveys, I highly recommend checking out ySense. It's a. If you want to earn rewards and get paid for surveys online, then why not sign up to Opinion Outpost today! opinion outpost most commonly asked questions. How. Triaba surveys offers you the possibility to make money with online surveys and with surveys on your cell phone. Fill out surveys quick and easy and you will. This channel will show you legit ways to make extra money online using mainly 10 Best Paid Survey Sites in that Actually Pay (% Free & Legit). But the reality is these lists are actually free on reputable online paid surveys sites. You shouldn't ever have to pay a fee to complete paid surveys online. MyPoints is a paid survey and rewards website best known for its cash-back rewards and sign-up bonus. You must be age 13 or older and live in the U.S. or Canada. Need extra cash? Start taking online surveys for cash or gift cards. Collect points for every survey you complete and get paid. It's that simple. You may have heard us mention Qmee* for its browser add-on that pays you to Google. It's now better known for its surveys for cash, and you can take part online. Qmee not only has paid surveys - our hand-picked money earners let you earn real cash when you make a purchase. You can also get yourself some money off. If you're looking for online survey websites that actually pay you for completing surveys, I highly recommend checking out ySense. It's a. If you want to earn rewards and get paid for surveys online, then why not sign up to Opinion Outpost today! opinion outpost most commonly asked questions. How. Triaba surveys offers you the possibility to make money with online surveys and with surveys on your cell phone. Fill out surveys quick and easy and you will. This channel will show you legit ways to make extra money online using mainly 10 Best Paid Survey Sites in that Actually Pay (% Free & Legit). But the reality is these lists are actually free on reputable online paid surveys sites. You shouldn't ever have to pay a fee to complete paid surveys online. MyPoints is a paid survey and rewards website best known for its cash-back rewards and sign-up bonus. You must be age 13 or older and live in the U.S. or Canada. Need extra cash? Start taking online surveys for cash or gift cards. Collect points for every survey you complete and get paid. It's that simple.

Swagbucks: Take Paid Surveys, Get Cash and Free Gift Cards*, Find Money Making Deals Swagbucks is the place to get paid for your opinion. Take thousands of. Swagbucks: Take Paid Surveys, Get Cash and Free Gift Cards*, Find Money Making Deals Swagbucks is a free reward app where you get paid for your opinion. Surveys. Simply answer a set of questions without screen, audio, or video recordings. Complete on any device for a flexible way to earn! There are cool ways to make some extra cash, especially when you can make it from the comfort of your home. But are online surveys actually worth investing your. This excellent paid survey site is also well-known for its instant payouts. The rules are simple: you answer questionnaires and earn gift cards and PayPal money. Make money online by answering paid surveys. Immediately earn money for each online survey you successfully complete and get free cash or gift cards! Swagbucks: Swagbucks is one of the most popular survey sites that offers a variety of ways to earn money, including surveys, watching videos. Join alybaba.site and start taking surveys for cash today! Get paid with surveys and enjoy earning money online with our exciting paid surveys! 2. MyPoints. A generous $10 sign-up bonus welcomes you to MyPoints and gives you a taste for easy earning. · 3. Opinion Outpost · 4. Survey Junkie · 5. Toluna · 6. Need extra cash? Start taking online surveys for cash or gift cards. Collect points for every survey you complete and get paid. It's that simple. You just landed at the perfect app to make money. Introducing CashPiggy; The app that pays you real money, gift cards to do simple tasks like giving. In MyGov India, the points are given after completing a particular online survey. The points then can be converted into cash. Money is paid via platforms like. Have you ever thought about making some extra money by filling out surveys online? It sounds too good to be true, right? Well, it's actually. Paid surveys · 17 Companies Offering Paid Online Surveys for money (Up to $/Week) · 52 Legitimate Survey Sites that actually pay in ! · 10 Free Paid Legit. American Consumer Opinion · Survey Junkie · Swagbucks · InboxDollars · Branded Surveys · Prime Opinion · Five Surveys · Prize Rebel · MySoapBox. If you're aiming to make some quick cash through online surveys, FreeCash should be on your radar. They typically process payments within two minutes, though. Get Paid by Completing Online Surveys · Earn real cash for each survey you complete · Earn even more by checking in with Zapper's Rewards · Cash out with PayPal. This site offers plenty of ways to earn money, including completing surveys, playing online games, watching videos, etc. After completing a survey, you get SB. The survey sites that pay the most money include Survey Junkie, Swagbucks, Inbox Dollars (Daily Rewards for Canadians), and Branded Surveys. To make the most.